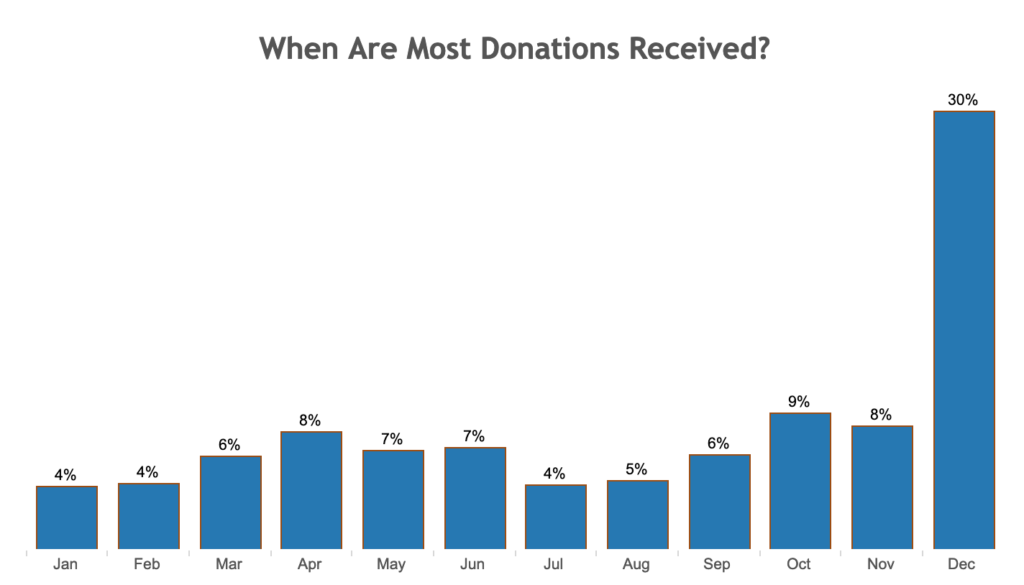

31% of All Online Giving Happens in December

LeadershipDid you know 31% of all online giving occurs in the month of December? 18% of total giving happens in December. And, even more shocking is this statistic – 12% of all giving occurs during the last three days of the year!

Here’s a snippet from Network for Good’s Digital Giving Index infographic recapping 2015 giving. (view infographic online)

Many of your givers often want to make their year-end gift on the very last Sunday of the year. This year that Sunday falls on December 25 – Christmas Day – while your people may likely be out of town enjoying celebrations with relatives and friends. More significant – I see many churches in my area not even planning to have worship services on Christmas Day this year. (If you’re doing an online or streaming service on Christmas Day, make sure your offering moment is well prepared!)

I anticipate there will be several who will drive to your church office during the last week of the year to give that last gift in time to include it in this year’s tax deductions. (I remember doing this more than once before the convenience of online giving.)

What should you be doing to prepare for this?

ALERT – First – check with your online giving provider

Online giving providers often have different deadlines at year-end for gifts to count in the current calendar year for tax purposes. You need to check with your provider to learn their particular deadlines. In checking with one of the largest online giving providers, Vanco Payment Solutions, their end-of-year deadline for gifts to count in 2016 are as follows:

- Debit/Credit Card Gifts – must be submitted by 3pm Central time on December 31

- ACH Gifts – must be submitted by 3pm Central time on December 29

Begin educating your people now:

- Promote all of your e-giving options heavily – online, text-to-give, mobile app, etc. Make sure people understand deadlines for gifts to count in 2016.

- Create a video showing how easy it is to make an online gift.

- If you offer mobile giving, do a brief demo in worship this month. Encourage your people to take out their smartphones and try it right then, on the spot!

- Remind everyone that gifts received after December 31 will go on the 2017 giving statement.

- Post your office hours that last week of December – make sure people know the times they can submit that final gift of the year if they don’t want to do it online.

- Remember: if people can’t give to you but still want to make a charitable contribution that counts toward their tax-deductible charitable contributions for the year, they will likely give it somewhere else! Convenience counts.

Plan and implement an end-of-the-year online giving appeal:

- December 21: Send an email reminder for the final Sunday offering of the year. In it, link to your online giving page for those who will be absent on Christmas weekend.

- December 26: Send an email containing a “story of life change” from one of your ministries and offer information regarding the tax-deductible giving opportunity that exists through December 31. Link to your online giving page.

- December 29: Send a “last chance to give” email with a direct link to your online giving page. Highlight the deadlines for online gifts to count.

I realize this might sound like a frontal assault on your people, but trust me – they are receiving similar year-end giving appeals from several non-profits they have supported in the past. You must work hard to keep your ministry top-of-mind for giving throughout the end of the year, THE month for the highest charitable donations in the US.

You must work hard to keep your #ministry top-of-mind for #giving throughout the end of the year. Click To TweetP.S. In case you are wondering, for tax purposes regarding gifts given by check:

- an offering received on or before December 31 can be counted on a 2016 tax return.

- an offering mailed through the postal service can be counted on a 2016 tax return if it is postmarked on or before December 31, regardless of when it is received in the church office.

- an offering delivered via FedEx cannot be counted on a 2016 tax return (even if it is portmarked on or before December 31) unless it is received by December 31. If sent prior to December 31 but not received until January, it cannot be counted on 2016 taxes – regardless of the postmarked date.

Please do a bit of preparation ahead of time to help your people be generous during this Christmas season. And please reach out with any questions you have. I would love to help you!